Part I: Values at War

“The most important thing to do if you find yourself in a hole is to stop digging.” – Warren Buffett

When I learned that the founder of a company I invested in had not only volunteered to work at DOGE, but specifically worked at the Dept. of Veteran Affairs, it was clear that he had wildly different beliefs and ethics than me.

As I read about Sahil Lavingia being proud to “serve” those who served I was incredibly angry, and then I was completely disgusted when he used his position to garner media attention for himself, which got him fired, which he then used to get more media attention.

His self stated goal from the beginning was based on a selfish and egotistical desire to “ship code for the federal government” and it’s clear he knew this was going to get him a lot of attention (and he was right).

Feeling a bit of online rage I updated my LinkedIn where I mentioned the investment I’d made, and emailed support at Republic (which hosted his raise) and Sahil Lavingia himself to ask about getting out of my investment.

The support team of Republic wrote back and said:

Ultimately, for a company to repurchase your security and formally release you from your investment, both the issuer and the investor must agree to the terms. This process typically requires the issuer to engage legal counsel to draft a proper release agreement. If the issuer in this case, Gumroad is not willing to entertain a repurchase or release, then unfortunately there is no mechanism to unilaterally relinquish your investment.

And I didn’t hear anything from Sahil Lavingia.

A month later, feeling trapped and frustrated, I posted a ‘Review” to the Gumroad listing on Republic laying out my issue. It was buried in the 1,792 other reviews but I felt that at least I had a public record of my disappointment.

I was a little surprised when I got an almost immediate response from Republic.

So now I had to make a decision about what I wanted, so I took it to the shareholders:

🗳️ Private Investment Pickle: Renounce My Gumroad Investment

After a it of discussion the shareholders helped me to check my emotions and decide if the ethical choice outweighed the financial choice. It was a very close vote, but they agreed I should sever ties.

Part II: Terms of Disengagement

Exit is the foundational right in any system. Without it, you’re a subject, not a participant. — based on Exit, Voice, and Loyalty by Albert O. Hirschman

Now I was committed on what to do, but pretty unsure on how to do it. I find it pretty strange that a person can’t just leave an investment. I mean, I “own” it but I can’t transfer it, sell it, or even destroy it?

So I started to dig into what the agreement actually was that i signed, and what that means in terms of obligations. I am not a lawyer, but I came up with the following arguments for why I should be allowed to exit:

- Nature of SAFE as a Contingent Right, Not Equity

A SAFE is not a share of stock or ownership interest in the company; it is a contractual right to potentially receive future equity upon a qualifying event (e.g., Equity Financing or Liquidity Event). As such, no equity interest exists yet that requires divestiture or formal transfer under corporate law. - Absence of Consideration for Future Equity Unless Triggered

Given that the SAFE only converts upon specified future events, and none have occurred, I hold an executory interest, not a vested one. So I’d argue that I am choosing to waive any claim to this contingent right, effectively treating the original purchase ($350) as a sunk cost. - Doctrine of Waiver

My understanding is that under contract law, a party may waive a contractual right by clear and intentional relinquishment. This is especially applicable to non-material terms or benefits that have not yet vested. So I’d argue I am unilaterally waiving all rights under the SAFE, including any potential future conversion rights or cash-out rights. - Public Policy and Disassociation

Because my motivation is reputational disassociation, I’d also argue that continued nominal association against my will (even as a non-voting, non-equity stakeholder) constitutes reputational harm, which I think supports a waiver or release request under public policy grounds. - No Harm to the Issuer

Because the SAFE involves a non-refundable contribution, and Gumroad has already received and used the funds, there is no financial or operational harm to the company by allowing a voluntary forfeiture. In fact, it reduces their future capitalization obligations!

With my decision ratified by shareholders and my arguments laid out for my case it was then time to make the ask. I did this in via an email to Sahil Lavingia where I wrote a professional but firm email with an attached PDF of my signed Waiver and Voluntary Relinquishment and my arguments.

Subject: Relinquishing My Investment in Gumroad

Hi Sahil,

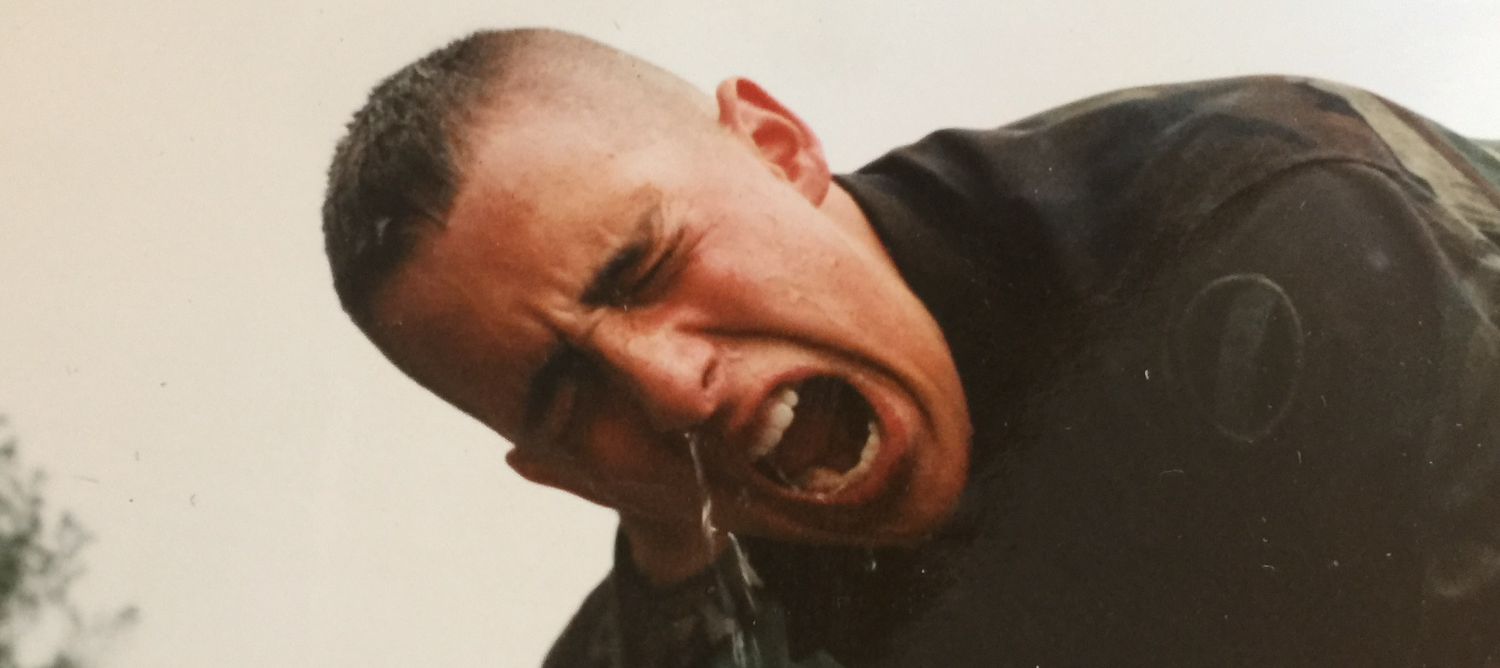

I’m writing as an early investor in Gumroad through the 2021 crowdfunding round. But more importantly, I’m writing as a U.S. Army veteran who once believed in what you were building.

I was proud to support a platform that seemed to empower creators and challenge traditional gatekeepers. But recently, I learned about your volunteer work with DOGE, and specifically your involvement in using AI to evaluate and recommend reductions at the Department of Veterans Affairs. I can’t overstate how deeply disappointing, and frankly, personal, that feels.

The VA isn’t perfect, but it represents a promise: that those who serve their country won’t be forgotten. Cutting services, especially under the guidance of algorithms and outside consultants, feels like a betrayal of that promise. It’s not just a policy disagreement, this is a moral line I can’t cross.

Because of this, I’ve decided to publicly and permanently forfeit my SAFE investment in Gumroad. I want no association, financial or otherwise, with the company going forward.

I hope you’ll understand and respect this decision. I ask that you formally acknowledge my relinquishment and ensure I am removed from all investor-related materials and communications moving forward.

This is more than just a statement, it’s a stand, and I intend for it to be public. I believe who we choose to associate with matters, and I no longer wish to be associated with you or your endeavors.

Sincerely,

K. Mike Merrill

Part III: No Exit

“Uncertainty is the price of agency.” — KmikeyM

After all my effort and feelings with this situation, I was quite surprised when I got an email back in about an hour from Sahil Lavingia.

No intention to cut services, but increase them by redirecting resources away from those that weren’t serving veterans. You should read my blog itself.

There’s no way to relinquish your investment to my knowledge but will keep in mind if there is in the future.

Sahil

This is exactly what I should have expected. It’s noncommittal, evasively framed, and strategically defensive.

“No intention to cut services…”

He’s asserting that it wasn’t cuts, but efficiency he was after. This is classic policy spin: reduce line-item A and increase line-item B, claim a net moral gain. But it’s pretty obviously bullshit, as he signed on under Musk who was appointed by Trump who both claimed over and over that the goal was cuts. To claim that was not his intention speaks to incredible stupidity about the world he was entering, and also completely side-steps that intent doesn’t negate impact. My objection was based on values and association, not the budgetary math of his “intentions.”

“You should read my blog itself.”

A wonderfully dismissive attempt to reassert narrative control without engaging my moral position, as well as another incredibly stupid assumption that I had not read it. His knee-jerk reaction views my interpretation as misinformed and not morally valid, likely because it attacks his sense of self. He can’t acknowledge my personal stake or veteran identity because it undermines his egotistic view as someone who was trying to “help.”

“There’s no way to relinquish your investment to my knowledge…”

The key phrase here is “to my knowledge”. This is strategic vagueness, a way to avoid liability by claiming ignorance. He absolutely could facilitate a waiver or internal notation of disassociation, even if it was just symbolic. But he’s opting out because it sets a dangerous precedent (I’m likely not the first person to be unhappy about his associations and volunteer efforts).

“Will keep in mind if there is in the future.”

A clear fuck off line that says I don’t want to deal with this.

What’s Next?

I knew the system offered no formal exit, but I still hoped a direct well-thought out appeal might matter. Why would anyone want an unwilling, antagonistic investor?

Instead, I got what most power structures run by bootlickers deliver when confronted by dissent: fearful dismissal wrapped in plausible deniability.

I am, functionally, still a shareholder. Not by choice, but by design. The architecture of these agreements offers no off-ramp. A SAFE is not equity, not a loan, and not ownership. It’s a belief system codified into legal paperwork. And like most belief systems, it has no protocol for renunciation. (That’s one reason I love markets: they allow exit.)

So this is my public notice.

I reject this association.

I reject Sahil Lavingia and his ego-driven projects.

And if I can’t leave quietly, then I will stay very loud.

🧾 Uninvestor Resources

If you participated in the Gumroad SAFE and are now seeking disassociation, you’re not alone.

- 📄 Template Letter: Access my waiver and arguments as a Google Doc

- 📧 Need Contact Info? I can share Sahil’s email upon request by other investors.

This is about more than an investment. It’s about consent, values, and the right to exit. If enough of us make our positions clear, we set a precedent for ethical disengagement and send a message of accountability.

You must be logged in to post a comment.