These are my notes for the K5M Book Club on the book Reimagining Capitalism, by Rebecca Henderson.

Chapter 1: “When the facts change, I change my mind. What do you do, Sir?”

Prologue

I didn’t love the prologue. I mean, I get it, she loves trees, but the understanding she eventually comes to that “our singular focus on profit at any price was putting the future of the planet and everyone on it at risk,” seems… obvious? I mean, I landed in Portland in the late 90’s so maybe anti-capitalism was just more accessible, but this is not a wild and new idea.

“… the eccentric idea that business could help save the world.”

This is a pretty eccentric idea, and one I do not think is actually possible. I think it will take government regulation and enforcement to curb the evils of big business, which is able to use politics far more effectively than regular people, so maybe we’re actually going to lose? Which makes me think that the idea of business saving the world is not eccentric ENOUGH. We need to go further.

“Can I really make money while doing the right thing? and Would it make a difference in the end if I could?”

This sets a very high bar for the book, because by the end of the month we should all be convinced of that, and I’m currently pretty skeptical!

She mentions working with companies facing massive change and they are three massive failures (GM facing Toyota, Kodak facing digital cameras, Nokia facing Apple). This is not a great example of her resume…

Chapter 1

I love the first quote:

“The real problem of humanity is the following:

we have Paleolithic emotions; medieval

institutions; and god-like technology.”

–E.O. Wilson

Who is E.O. Wilson? He’s a 91-year old biologist who has written more than 15 books.

I also love starting with “What is capitalism?” as the first question, but she doesn’t really answer it. Which I understand as it is not really answered in Dr. Ritchey’s long essay entitled Is This a Sandwich?

I love frameworks, and I mostly agree the three great problems of our time are:

- massive environmental degradation

- economic inequality

- institutional collapse

She mentions that “Insect populations are crashing and no one knows why” which reminds me of my idea for Honey Futures: a Hedge Against the Apocalypse in which I wanted to get a bunch of honey, which is shelf stable for a really long time, and just hold on it and sell fractional ownership of it. That way if all the bees die you’ll own a sliver of this super valuable commodity. Good idea, right?

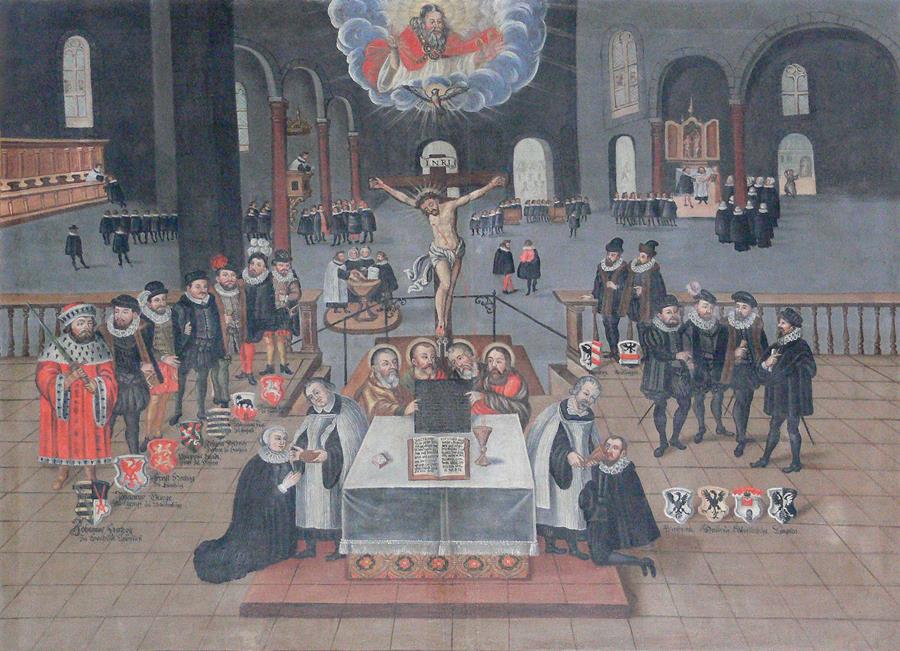

Getting into Chapter 1 I am still approaching this book with a skeptic’s mindset. I’m no scholar but claiming that BlackRock’s CEO Larry Fink’s statement that “companies must serve a social purpose” is on par with Martin Luther nailing his ninety-five theses to Wittenberg Castle’s church door seems like quite a stretch.

Four years after Luther posted his theses he was excommunicated by the Pope, later he was declared an outlaw by the emperor and his literature was banned and it was declared a crime for anyone to offer him food or shelter and permitted anyone to kill him without legal consequence.

Larry Fink, estimated to be worth more than $1 billion, is still the CEO of BlackRock, the largest money-management firm in the world with more than $6.5 trillion assets under management. So he seems to doing fine.

Another high bar she sets for the book is that “this book is an attempt to persuade you give your life to the attempt” to use capitalism to make the world better. Wow!

Milton Friedman

I liked the part about Milton Friedman and the context around the adoption of a lot of his thinking.

The idea that “there is one and only one social responsibility of business-to use its resources and engage in activities designed to increase its profits” is clearly so sociopathic and fucked up.

Maybe my favorite line from the whole first chapter is “In a nutshell, markets require adult supervision.”

I’ve always said that capitalism needs to be well-regulated! It can’t work any other way, and with companies gaining more and more political power… well, we’re fucked! As that 2014 study showing that it there is no change in the chance of a policy becoming law between 10% support and 90% support of citizens. What matters is business lobbying. Dark!

“The problem is not free markets. The problem is uncontrolled free markets, or the idea that we can do without government…”

This made me think of crypto, designed to act as an economic system outside of government regulation. This is great when it allows people try weird new innovative stuff, but it’s bad when people loose millions and there is no recourse and assists organized crime and dictatorships.