These are my notes for the K5M Book Club on the book Money, by Jacob Goldstein.

Chapter 5: Finance as Time Travel: Inventing the Stock Market

FINALLY WE’RE GETTING INTO THE GOOD PARTS! THE STOCK MARKET!!!!

“… trading and stealing stuff from faraway lands.”

Ah yes, the true origin of capitalism, THEFT!

I know this is going to sound radical, but I think it’s important to understand that capitalism doesn’t exist without violence and the history of capitalism is … not good. I’m not an anarchist, or at least I don’t identify as such, but this idea that property is theft makes a lot of sense to me.

“The essence of finance is time travel.” -Matt Levine

In case you don’t know, Matt Levine is the greatest thinker on finance and business. He is so great he is often talking about the details of things in banking that I do not, and will never, understand.

But you should follow him on Twitter and you MUST subscribe to his mailing list (he is currently on paternity leave, but still, sign up now so you don’t forget.

The vereenigde oostindische compagnie!

A trading company, given a government monopoly on all Dutch trade in Asia. And people could trade by going to the company headquarters and updating the ledger with the company bookkeeper.

Fun Fact: The term yacht comes from the Dutch and originally referred to light fast boats that their navy used to chase pirates. Yachts were introduced to England when the Dutch East India Company gave one to King Charles II who used it as a pleasure boat.

“It was the world’s first stock exchange.”

Though according to wikipedia:

“It is not quite accurate to call [Amsterdam] the first stock market, as people often do. State loan stocks had been negotiable at a very early date in Venice, in Florence before 1328, and in Genoa, where there was an active market in the luoghi and paghe of Casa di San Giorgio, not to mention the Kuxen shares in the German mines which were quoted as early as the fifteenth century at the Leipzig fairs, the Spanish juros, the French rentes sur l’Hotel de Ville (municipal stocks) (1522) or the stock market in the Hanseatic towns from the fifteenth century. The statutes of Verona in 1318 confirm the existence of the settlement or forward market … In 1428, the jurist Bartolomeo de Bosco protested against the sale of forward loca in Genoa. All evidence points to the Mediterranean as the cradle of the stock market. But what was new in Amsterdam was the volume, the fluidity of the market and publicity it received, and the speculative freedom of transactions.”

— Fernand Braudel (1983)

“thin market”

This feels like what we have with KmikeyM. The spread between buyers and sellers can be pretty wide, which slows trading down.

Investopedia defines it as:

A thin market on any financial exchange is a period of time that is characterized by a low number of buyers and sellers, whether it’s for a single stock, a whole sector, or the entire market. In a thin market, prices tend to be volatile.

A thin market is also known as a narrow market.

You can get a reprint of the 1957 edition of the 1688 book about the stock exchange on Amazon.

Joseph Penso de la Vega came up with four basic rules for playing the market:

- Never advise anyone to buy or sell shares. Where guessing correctly is a form of witchcraft, counsel cannot be put on airs.

- Accept both your profits and regrets. It is best to seize what comes to hand when it comes, and not expect that your good fortune and the favorable circumstances will last.

- Profit in the share market is goblin treasure: at one moment, it is carbuncles, the next it is coal; one moment diamonds, and the next pebbles.

- He who wishes to become rich from this game must have both money and patience.

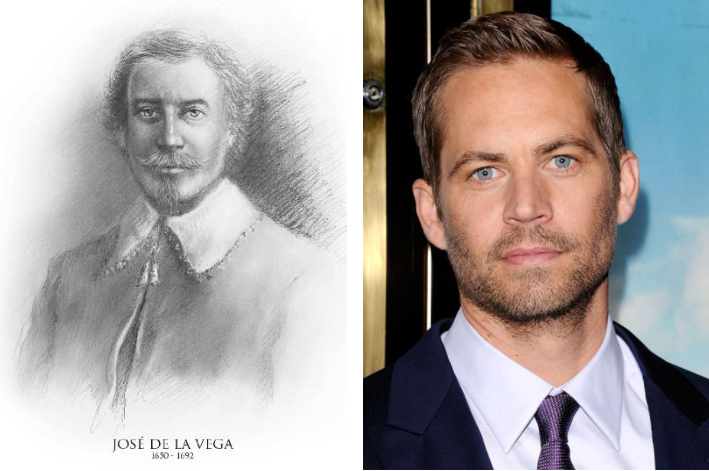

Don’t you think Joseph Penso de la Vega looks like Paul Walker? Paul Walker died when he was 40 and Joseph Penso de la Vega died when he was 42. #TooSoon

I pointed this out to Jacob Goldstein on twitter and he said:

Back to chapter 5…

Isaac Le Maire used a futures contract to try to take advantage of the VOC, but like the banks of today, the VOC was too big to fail, and got the government to change the rules and ban the selling of futures contracts.

I love futures contracts. I also love when people take advantage of the rules and then some people whine about it and get the government to change the rules. Actually, no, I hate that. Have you heard about onion futures? It’s the best story in all of capitalism and shows how stupid and short sighted government is.

I’m actually working on bringing back onion futures. 🤞

Another example in the book but also real life of things that are legal but other people love to whine about is short selling. The end of the chapter talks about Isaac using his futures contracts to enable short selling and how the the VOC said it wasn’t fair. Elon Musk, a psychopath, is often screaming on Twitter about shortsellers.

But my favorite anti-short CEO of all time is Patrick Byrne of Overstock.com. Unfortunately he got cancer or Hep C or something right in the middle of his anti-short campaign but he came up with this ingenious solution!

First, he “tokenized” shares of Overstock on the blockchain, and then he paid special token dividends I think? Wait, here is an article that kind of talks about it. But the way he engineered it was so that those shorting his company didn’t get the dividends, but were on the hook for them. So he created this amazing crypto-tax only on naked short sellers. Brilliant! But I don’t think he ever actually launched it? And sadly he went crazy and fell into a Deep State conspiracy hole.

Isaac Le Maire has the greatest tombstone ever.

“Here lies Isaac Le Maire, merchant, who, during his activities over all the parts of the world, by the grace of God, knew so much abundance that in thirty years he lost (save his honour) more than 150,000 florins.”

Everyone should make sure to their next of kin that they want some kind of cool story about them on the tombstone, not just boring names and dates!

I mean, Isaac was pretty rad and he had 22 children, which definitely seems like too many.

You must be logged in to post a comment.