These are my notes for the K5M Book Club on the book Money, by Jacob Goldstein.

Part II: The Murderer, The Boy King, and Invention of Capitalism

No offense to my former business partner, but this initial description of John Law reminds me a lot of my friend and shareholder Marcus:

He creates a modern economy for an entire nation, becomes the richest non-king in the world, and seizes control of nearly half of what is now the continental United States—but only after being convicted of murder, going on the lam for twenty years, and winning a fortune as a gambler.

This intro to section two with the promise of the dawn of the stock market and the modern corporation got me excited!

Chapter 3: How Goldsmiths Accidentally Re-Invented Banks (and Brought Panic to Britain)

“Ever since coins were invented, people had tried to steal a little metal out of them by clipping them along the edges…”

Oh man, this is what people do with collectible trading cards, but not to steal the precious flakes and bits they get but rather to make the cards seem to be in better condition. It’s called trimming.

And when I was looking at this back in January for some reason I found this blog post accusing former NFL pro Evan Mathis of being a card trimmer.

“England in the 1600s did not have a responsible government … buyer and seller had to decide: Is this coin worth what it’s supposed to be worth…”

Just yesterday I checked the Bloomberg Cafe Con Leche Index which has been tracking the hyperinflation in Venezuela since 2016 by looking at the price of a cup of coffee. I know clipping coins isn’t an inflation problem, but the constant uncertainty around what your money is worth seems to track with lack of responsibility in government.

“As a result, even when the British mint did make good new silver coins, people almost immediately took those coins out of circulation to go trade them for gold in another country.”

If it wasn’t for most of our money being electronic, would the US today suffer the same problem?

The IMF says,

Most $100 bills are held abroad. According to the Federal Reserve Bank of Chicago, nearly 80 percent of $100 bills—and more than 60 percent of all US bills—are overseas, up from roughly 30 percent in 1980.

This USA Today article explains how the Federal Reserve “makes” money,

It works like magic. With a few strokes on a computer, the Federal Reserve can create dollars out of nothing, virtually “printing” money and injecting it into the commercial banking system, much like an electronic deposit.

“The way you and I have checking accounts in our banks, that’s how all these other banks have accounts at the Fed,” said Pavlina Tcherneva, an economist at Bard College in New York. “All the Fed does is literally credit them. They just type it in.”

This 2011 article talks about M1 and M2 and works out how much of the US economy is in printed bills vs. “virtual” currency.

Actual cash comprises a bit more than 10.2 percent of the total money. This means that almost 89.8 percent of the money in the United States is not in the form of cash. (Remember this the next time you hear someone talk about how the government “prints more money” whenever they want.)

So the Federal Reserve in the US is the modern day goldsmiths of the seventeenth century.

When I was Googling Swedish plate money I found all these eBay auctions!

Interesting how the copper that Sweden was using for money wasn’t valuable unless in huge quantities, which pushed them to paper money, but the the value of the old money has increased as it evolved from currency to collectible.

⚠️ A PROBLEM WITH THE WHOLE THING ⚠️

This part about fractional reserve banking is making my head spin. I don’t understand how you can create money by loaning money out… I mean, I get how you can do it, but I don’t understand where the interest is supposed to come from.

Let’s simplify it. Imagine all the money in the world is just $100. Now pretend there is one bank and it has the $100 in it. The banker loans out the $100 with 1% interest rate. So the person taking on the loan has to pay back $101. But that extra dollar doesn’t exist, except as debt… but no one can pay it because there is only $100.

I feel like I’m missing something important in how all this works…

King Charles II was a real piece of shit.

The goldsmiths loan him a bunch of money and because he is above the law he just didn’t pay them back. That’s just being an asshole. To become a piece of shit he had some of the goldsmiths who had gone bankrupt but into prison, even though it was his fault of for not paying his debts.

Classic piece of shit move right there.

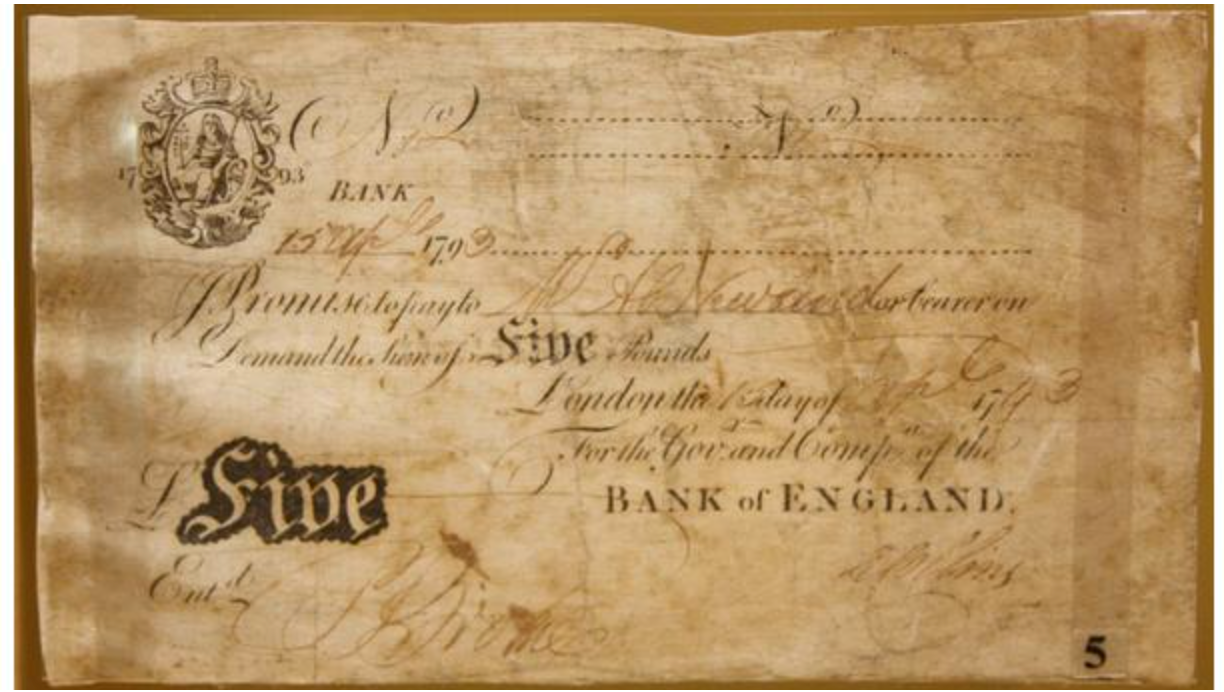

“The thing that makes money money is trust.”

I have a project that is based on trust. It’s called the Verified Trusted Authenticity Certificate which you can read about from this 2012 blog post.

“Law went off to boarding school, where he excelled in math and a subject called ‘manly pursuits,’ which, somewhat disappointingly, mostly means he was good at tennis.”

As someone new to the game of tennis, and currently reading this book while on a tennis vacation in Palm Springs, I am not all disappointed that tennis is (or, i suppose, was) considered a manly pursuit.

Tennis suffered under English Puritanism, as it was heavily associated with gambling, which we will see comes up again for John Law.

Other than noting his manly tennis pursuits I didn’t have a lot of notes about John Law’s First Act. This section was like reading the “Early life and education” section of someone’s Wikipedia page. Which is to say I enjoyed it (gambling problems, murder and palace intrigue, prison escapes) but it wasn’t as much about money.

You must be logged in to post a comment.