These are my notes for the K5M Book Club on the book Money, by Jacob Goldstein.

Chapter 10: The Gold Standard: A Love Story

Before we even get started, just based on the title, I’m reminded of the talk by Marcus Estes on “What Is Money” which is from May of 2020. This is the latest in a series of talks by Marcus.

The first time I asked Marcus to talk about money was maybe around 2010 when Judah Switzer and I were trying to figure out how to make money online, and we made a pilot video called The Money Blog which guest starred Marcus in a sauna explaining money (warning: explicit language).

Anyway, let’s get into the chapter!

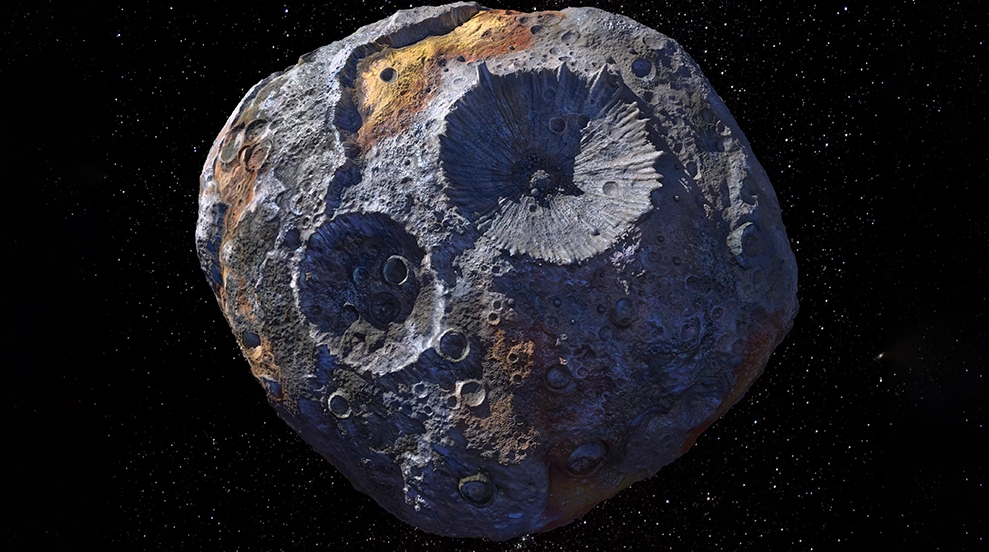

Gold is made when neutron stars collide. So while the amount on Earth is finite, the supply in the UNIVERSE is pretty great. There is an asteroid somewhere between Mars and Jupiter that is estimated to be worth $10,000 quadrillion in rare metals. That’s $10,000,000,000,000,000,000, or to put it into a framework we can better understand, that’s like 54,466,230 Jeff Bezos’. Or imagine Spain, but instead of Spaniards everyone who lived there had the net worth of Jeff Bezos. (Last chapter we were discussing Luddites and now we’re talking about space mining!)

You Can’t Explain Love

Goldstein says in the nineteenth century … politicians and bankers and intellectuals feel in love with the gold standard. But why? How do you explain this love? You don’t, we just all want gold so we can be rich. But why do they all love the same thing?

I’ve always found there is a great advantage when you value something different than everyone else. For example, if you’re playing a game, like Settlers of Catan, and you realize there is no way for you to win according to the rules written by Klaus Teuber you can decide to make your personal win condition to be making sure that another player is NOT the winner. Sure, no one at the table thinks of you as a winner when Paul gets second place, but the rules are just arbitrary! Klaus just MADE THEM UP! You can create your own rules, and for you, making Paul lose makes you a winner.

This is true of money/gold as well. If you choose something else to value above money then you are playing a wildly different game than most people. This has advantages and disadvantages, but it means at least you have a chance of winning your own game, since you are not going to win the money game.

This is kind of what Hume did. He said gold isn’t the standard, it’s just a relative way to buy cloth and coal and wheat, and the “common course of nature” keeps it all in balance. Of course, he never considered space mining, but even if had, it seems like he would have been all for free trade in the colonies (have you watched The Expanse? It’s good and it’s about space mining and labor issues.)

The Gold Standard

It’s really insane to think that an ounce of gold is worth $20.67. Not “today” but just, that is the price of gold. THE END.

“In essence the international gold standard was like having a single international currency.”

And then we see what happens next is what always happens…

“This was very good for rich people, whose money bought more and more stuff. It was very bad for poor people who owed money and had to keep working more and more just to make the same monthly payments.”

Wait, economics screwed over the poor to favor the rich? REALLY!? I AM SHOCKED. LOL.

The idea to add silver back into the mix seems like a very shortsighted solution to the problem of not enough gold. Once you make the gold standard a silver and gold standard, the same thing will happen with silver…

The Klondike

I grew up in Coldfoot, Alaska which was an old mining town in the middle of nothing Alaska. It was the discovery of gold in Alaska that pulled attention away from the Klondike to Alaska.

When my parents moved to Alaska in the 70’s they did some mining. My grandparents ran a mining supply store! I don’t remember any of this but I’ve seen pictures of it. When we lived in Coldfoot there were a lot of gold miners still there and I remember once a man came over to have my dad, the State Trooper, hold onto this gold nugget the size of your fist. I have no idea how much it was worth… but this story about the Butte Nugget says a fist sized gold chunk is about 6lbs and gold prices were around $1,000 an ounce in the 80’s, so this was a guy who pulled something like $100,000 out of the dirt behind his house.

Irving Fisher

This description of Irving Fisher is totally a “type of guy” we are very used to (Elon Musk, Mike Bloomberg, or really any business leader who loves crypto and/or politics too much):

“… health food zealot, fitness guru… invented a card filing system to organize all his projects … proponent of eugenics … proposed a thirteen-month calendar, a simplified spelling system, and a new system for making maps.”

Look, some of that (like the filing system) really appeals to me, but I’m always suspicious of business people who decide to get into politics. NEVER TRUST THEM. Business and politics are not the same, and should not be the same.

Fisher’s “Money Illusion”

The problem with Fischer’s fucked up salary system and belief in his money illusion is that most of us are not dealing with enough money to care about inflation. Sure, sure, the house I sell isn’t worth as much because I could buy more in the past, but most of us don’t get to own a house, and if we do, we sell it and buy one other house. So it’s not like we’re playing Monopoly or looking to maximize our investments. It’s a different game in the trenches!

1% change on a million is a lot. 1% change on a dollar isn’t a big deal. Fisher was rich, and he had rich people problems. But I mean, I agree the gold standard is dumb.

When he was creating and selling his infographics I thought immediately of USA Today’s infographics:

(Bummed I couldn’t find anything online about Fisher’s Battle Ball but at least the XFL is coming back.)